Why Budgeting Matters — Especially Right Now

In an era of rising costs and unpredictable paychecks, mastering the art of budgeting isn’t just smart—it’s your financial safety net

Finistack

9/27/20254 min read

Even in “normal” times, households face pressure from rising costs; in 2025, U.S. inflation is hovering around 2.9 % annually (CPI). That means what cost you $100 a year ago now costs about $102.90 — not a huge jump, but over multiple expense categories it adds up.

At the same time, many households still struggle with irregular income or “financial surprises.” The Federal Reserve’s 2025 report found that 11 % of adults said they’d had difficulty paying bills over the past year because their income varied month to month.

Historically, even among people who do create a monthly budget, overspending is common. According to NerdWallet, about 74 % of Americans say they have a monthly budget, but 83 % admit to overspending it at least sometimes. That’s like having a map but still getting lost. The difference is in dynamic adjustment, not rigid perfection.

So the goal here is a living budget—one you can live with, tweak, and use to steer your financial life, not a straightjacket.

Step 1: Build Your Income & Expense Baseline

Tally all income sources

Include your salary, bonuses, side gigs, freelancing, dividends—every dollar that enters your pocket. If your income fluctuates, average the last 3 to 6 months to smooth out peaks and dips.

Track expenses for 90 days

Gather bank statements, credit card statements, receipts. Classify everything: rent/mortgage, utilities, groceries, transport, insurance, debt payments, subscriptions, entertainment, etc. You’ll often uncover “invisible” categories—snacks, app purchases, convenience fees—that sneakily drain money.

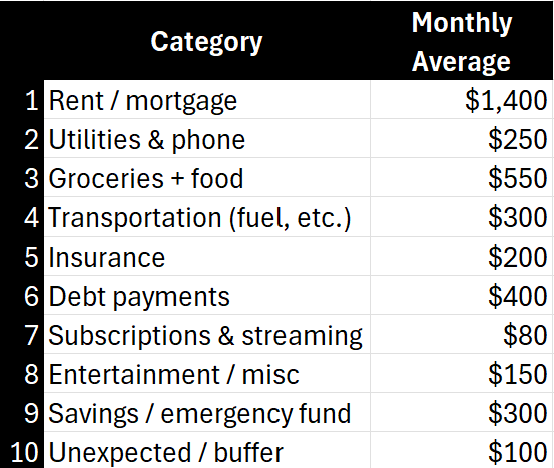

Example

Say over three months you averaged $5,000/month in income, and your tracked expenses look like this:

That sums to $3,730—leaving $1,270 as breathing room for more saving or adjusting for inflation creep.

Step 2: Choose a Budgeting Framework You’ll Stick To

50/30/20 rule (classic)

50 % Needs | 30 % Wants | 20 % Savings / Debt

In the example above, “needs” might include rent, food, transportation; “wants” cover streaming, entertainment, shopping; “savings/debt” is the rest. If needs push above 50 %, you’ll need to trim wants or reallocate.

Zero-based budgeting

Every dollar gets a “job.” Income minus expenses equals zero—whatever’s left is used for goals or buffer. It forces intentional decisions.

Sinking funds / buckets

Instead of “miscellaneous,” create buckets for predictable but irregular costs: car maintenance, insurance premiums, gifts, holidays. Allocate, say, $50/month toward “car fund” so when your car needs a service, you’re not surprised.

You might blend:

Use a 50/30/20 structure, but also maintain sinking funds for irregular costs.

Step 3: Automate the Non-Negotiables

Once you’ve got the structure, set up automatic transfers or payments:

Right when your paycheck lands, divert a set amount to savings / emergency fund

Automate minimum debt payments

Set auto-pay for utilities, insurance so you don’t miss due dates

This removes the friction of decision-making and ensures critical items are taken care of before discretionary stuff.

Step 4: Monitor, Adjust, and Reforecast

A budget is not etched in stone. You must revisit and adjust monthly or quarterly. Here’s how:

Mid-month, check your “big categories” (groceries, utilities). If you’re 70 % through the month but already 90 % through your grocery line, you know a course correction is needed.

At month’s end, compare actual vs. planned. What surprised you? What trends are forming?

Adjust next month’s numbers. If your internet bill jumped, raise that line; if you underspent entertainment, you could reallocate.

Over time you'll build a sense of “safe ranges” rather than rigid caps.

Step 5: Guard Against Inflation & Price Pressures

Because inflation persists (~2.9 %/yr), some categories creep upward year after year:

Groceries: try bulk buying, store brands, seasonal produce

Utilities / energy: switch to more efficient appliances, monitor usage

Insurance / telecom / subscriptions: periodically shop for better deals

Also, build “inflation buffers” into your budget. For example, increase your food line by 3 % each year or set aside a small inflation reserve.

Step 6: Include Psychological / “Fun Money” to Maintain Discipline

If your budget is too strict, you’ll rebel. Everyone should have a guilt-free “fun” or “joy” line. Maybe $50–$100/month just for treats or impulse buys. The key is: it’s pre-approved. That reduces the temptation to raid your savings or emotional splurges.

Step 7: Link Budgeting to Real Goals & Track Them

A budget gains meaning when tied to goals: emergency fund, paying off credit card, saving for a down payment, travel fund. For example:

Emergency fund goal: 6 months of expenses → $3,500

Debt payoff goal: $2,000 on credit card by year-end

Travel fund goal: $1,200 for next summer

Use a progress tracker (bar chart, thermometer) to see monthly progress. It feels rewarding when you see your “debt bar” drop or savings bar go up.

Real-Life Scenarios & Tweaks

If income drops

Let’s say next month your income falls to $4,200 (from $5,000). That’s a 16 % drop. You could:

Immediately trim “wants” or entertainment

Delay extra savings and maintain just the core emergency contributions

Lean on your buffer or flexibility (you allocated $1,270 left earlier)

Tap a side gig or temporary work

If a big expense hits

Your car needs a $600 repair. If you have a “car fund” built up via your sinking fund, you cover it without stress. If not, that cost would have to come from your discretionary, or (worse) from credit. Over time, your buffers smooth these hits.

If inflation pushes your cost higher

Suppose groceries cost 4 % more this year. That $550 line becomes $572. You might raise your grocery allocation and trim somewhere else—maybe your “miscellaneous” line becomes $130 instead of $150, or you try to recoup elsewhere.

Summary Thoughts

A robust budget is part data, part behavior, part living system. Here’s the short version:

Know your baseline: income, expenses, trends

Pick a framework you can stick with

Automate must-haves (savings, bills, debt)

Monitor and adjust constantly

Account for inflation and surprises

Give yourself breathing room with fun/joy money

Tie to goals so the budget feels meaningful

Start simple. Even tracking for 30 days gives huge insight. Over time, a flexible, data-informed budget becomes your best ally against stress, surprises, and spending drift.

*Disclaimer: This blog may include AI-generated content derived from web crawling, and it features quotes from original-cited inline or public sources. The information presented is for general informational purposes only and may not reflect the most current data or information available. While we strive for accuracy, we encourage readers to verify the information from original sources or reach out to a certified financial adviser for important financial decisions.

Follow Finistack on social media

Have abundant mindset, add value to this beautiful world, and enjoy your life the way you envision.

We move fast, so things aren’t always perfect. Help us level up — Share your feedback.

© 2026 Finistack LLC. All rights reserved.

Terms of Use

Privacy Policy

Terms and Conditions

Contact Us

About Us